Unbelievable Tips About How To Claim Sales Tax

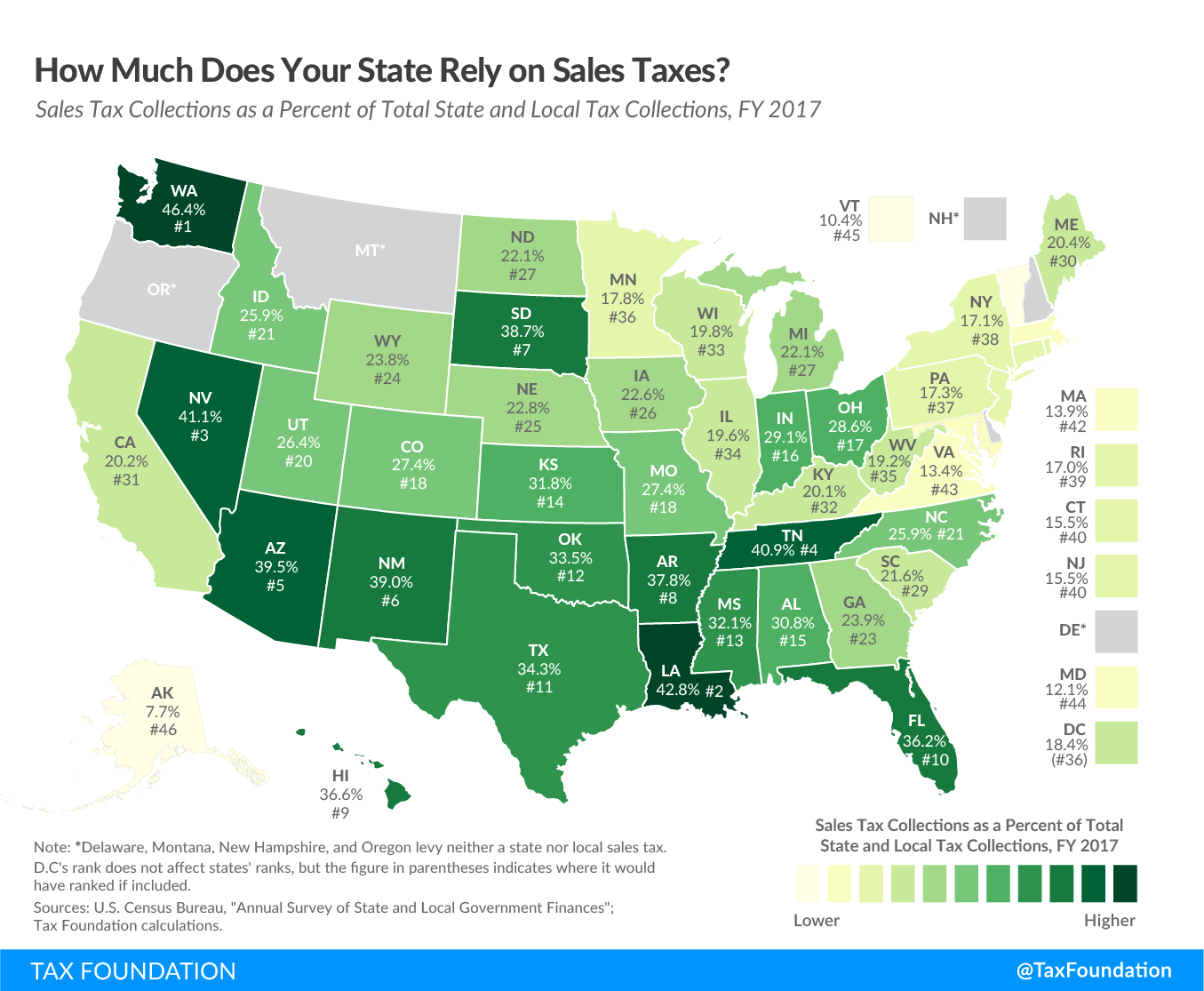

Many states collect both a statewide sales tax and local city or county sales taxes as well.

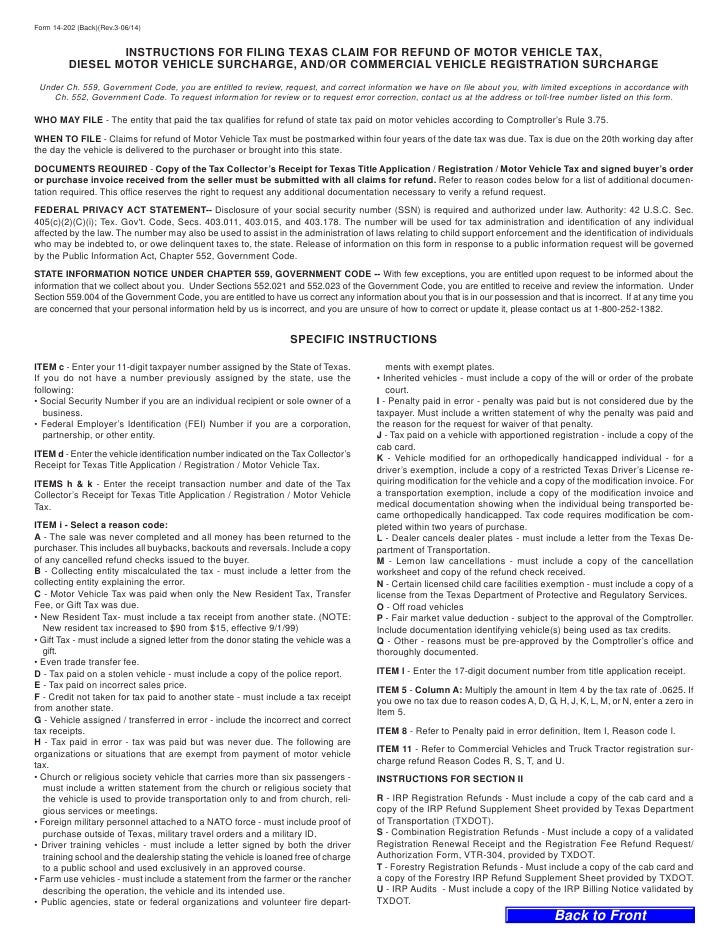

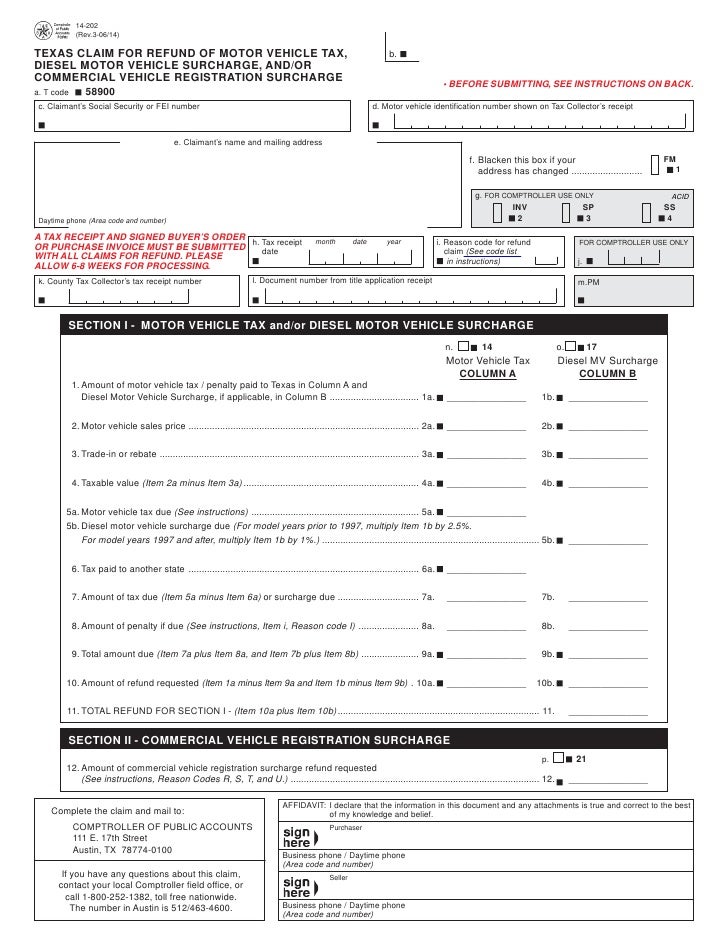

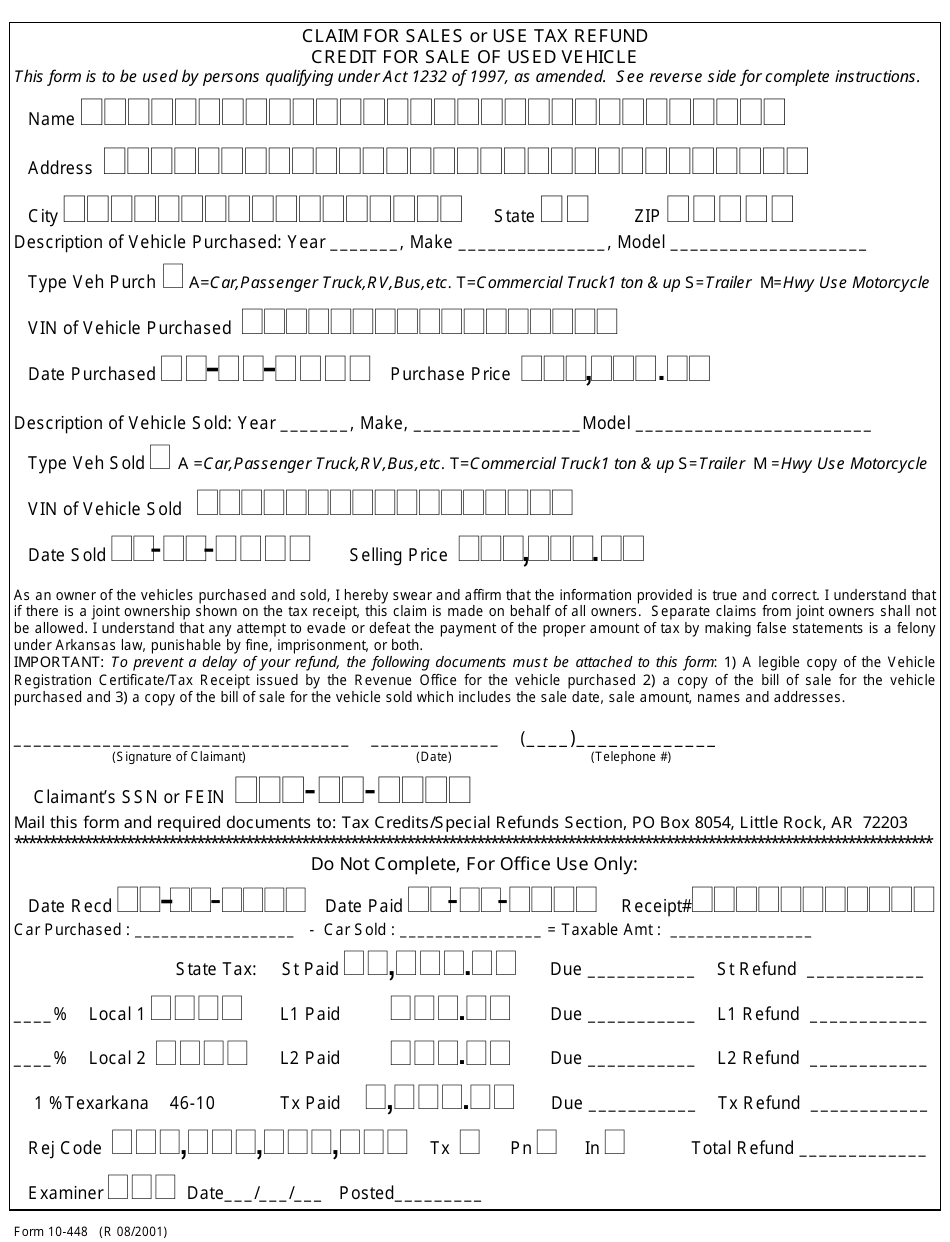

How to claim sales tax. Sales tax is a consumption tax on the sale of most (but not all) goods and services. For a list of discretionary sales surtax rates, visit the department's forms and publications webpage and select the current year discretionary sales surtax information (form dr. Many states don’t collect tax, or collect lower taxes, on essential product categories like groceries (see example for new york).

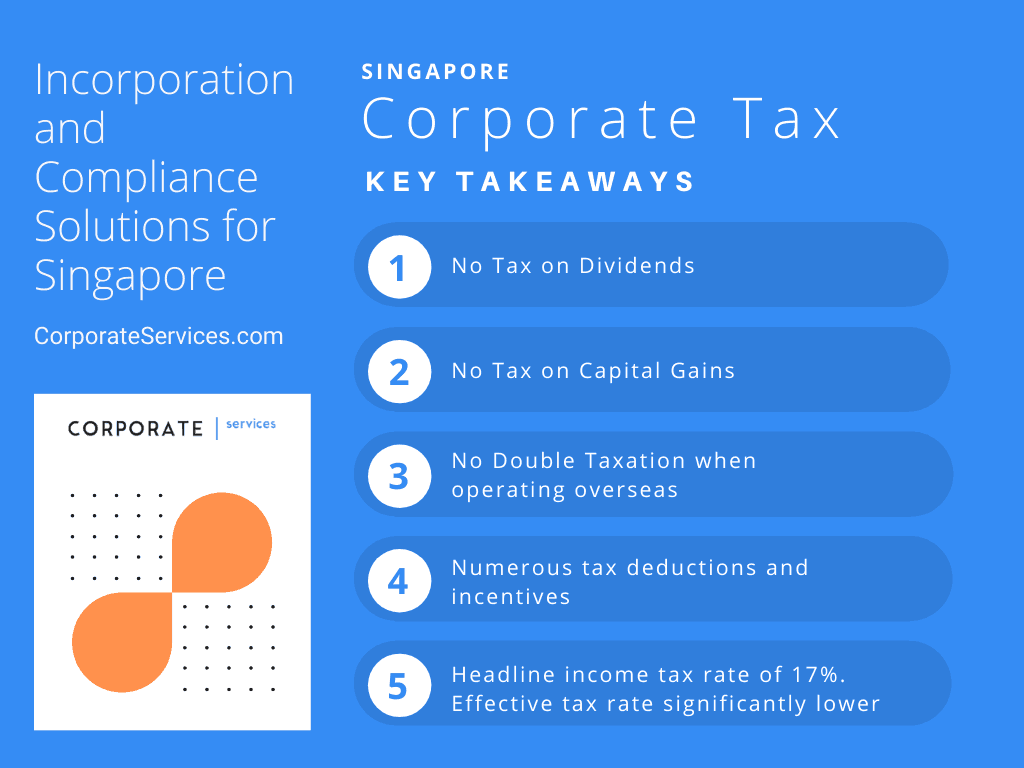

In this guide, we’ll help you understand when to charge sales tax, including how much sales tax you need to collect depending on your state. This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on. Annual limits on energy efficient home improvement tax credits.

The sales tax limit for tax year 2023 is $10,000 — or $5,000 if you’re married and filing separately. For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, you’ll need to separate the tax from the gross amount. Biden announced tax incentives for families willing to shelter migrants in exchange for labor.

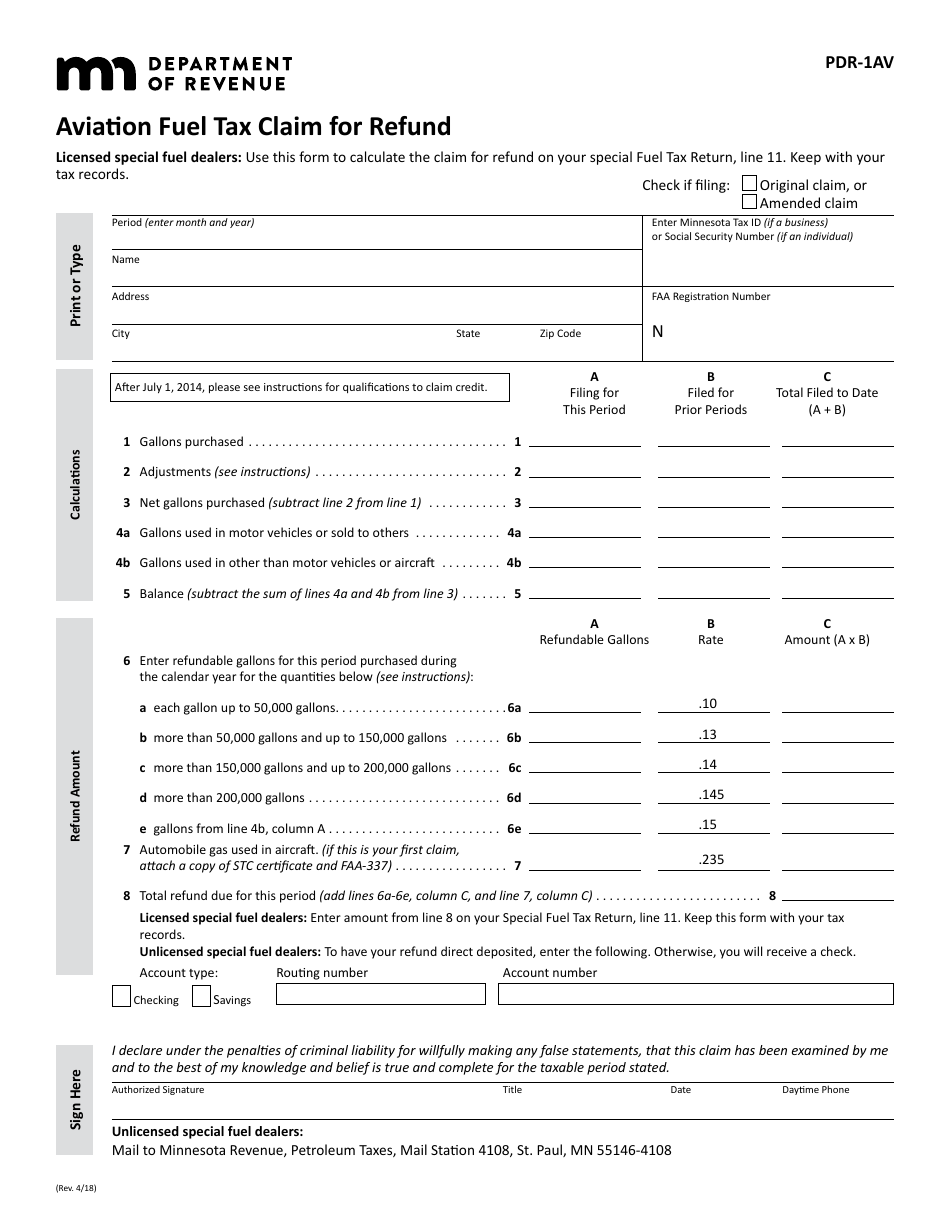

The sales tax for the. If total annual sales tax collected was less than $60,000, then you can claim a.073% discount. It’s usually collected at the point of sale and expressed as a percentage of.

18 instagram post (direct link, archive link) shows. If you go with the sales tax deduction, you can claim the sales taxes you paid on just about anything you bought, whether it was purchased online or locally, in. For example, if you paid $7,000 in state and local sales taxes in 2022 and also $7,000 in state and local income taxes in 2022, you could claim a $7,000 sales tax.

If total annual sales tax collected was between $60,000 and $600,000. Answer a few questions about yourself and large purchases you made in the year of the tax return you are completing. Enter your information for the tax.

Add up all your receipts (actual expenses) or use the predetermined. Starting in 2018 with the tax cut and jobs act, both the sales tax deduction and the income tax deduction have been capped at $10,000. Before you collect sales tax from your customers, here are some specifics that can influence how you manage, collect,.

You can choose to claim sales tax by itemizing deductions or claim the standard deduction, but not both. There are two methods for coming up with the amount of sales taxes you paid during the year: Calculate your deduction using the optional sales tax tables.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. You must collect all applicable taxes, and you should generally collect. However, you might have deducted local and state sales.

At the end of the instructions to the schedule a attachment. All fields marked with an asterisk * are required. In addition to limits on the amount of credit you can claim for any particular equipment installation or home.

-480a.jpg)