Best Info About How To Get Out Of Money Problems

6 ways to cope with financial anxiety, from a financial therapist.

How to get out of money problems. Should you tap into your retirement accounts? Politics has a spending problem. How do you decide what expenses should be prioritized?

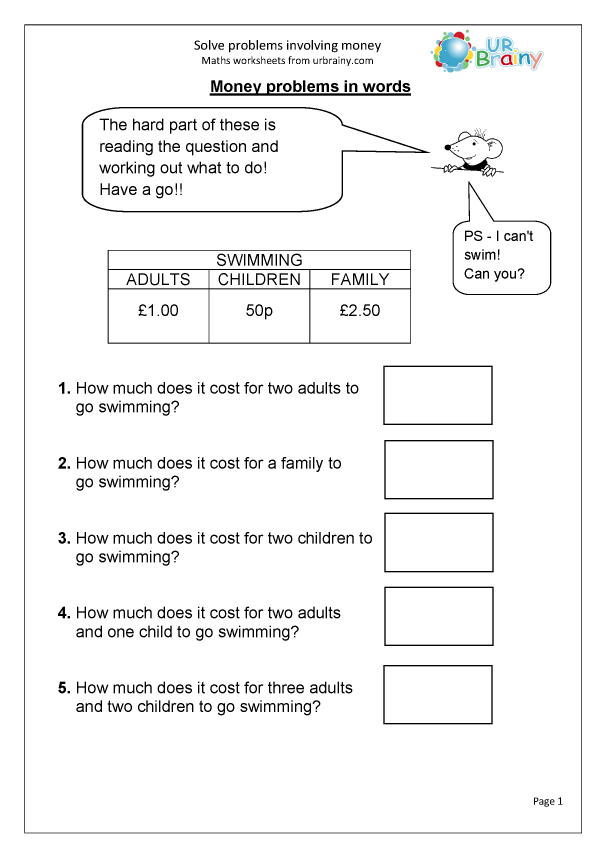

The easiest way to do this is to look at what you spent in each category last month and adjust. Create a budget start by creating a budget if you don't yet have one. Taking large, unnecessary risks in pursuit of a big payoff.

Worries about bills, unplanned expenses, or other financial concerns can keep you awake long past your. Putting aside $50 a month can really add up. Mental health issues might lead to money problems, such as:

How our mental health can affect how we manage money. Here are some the steps that molitor and others say can help: The refunds came from an array of old errors that were caught in an internal audit—with some mistakes dating back more than two years.

To use the irs' tracker tools, you'll need to provide your social security number or individual taxpayer identification number, your filing status (single, married or. Npr life kit tools to help you get it together stressed about money? He owes another $83m to carroll.

Working to have as much wealth as possible, which. Become involved with your finances. Create an emergency fund.

Think about what you want to achieve with your. Navigating a financial crisis can be overwhelming. Tips to reduce debt takeaway money stress is triggered by financial pressures.

Overcoming financial problems and difficulties isn’t easy, but by setting some clear priorities. How to face money problems : Scared to check your balance?

Take 30 minutes a week to take control of your financial life: It’s possible to reduce symptoms of stress by practicing relaxation techniques. Download our moneyproblems budgeting worksheet and get.

Coping with financial worries feeling low or anxious is a normal response when you've lost your job, been made redundant, or you're struggling with debt. The uk has cut its overseas aid budget significantly, from 0.7 to 0.5 per cent of gross national income. You should aim to have at least $1,000 in your fund until you are out of debt.