Brilliant Strategies Of Tips About How To Improve Your Credit Score Canada

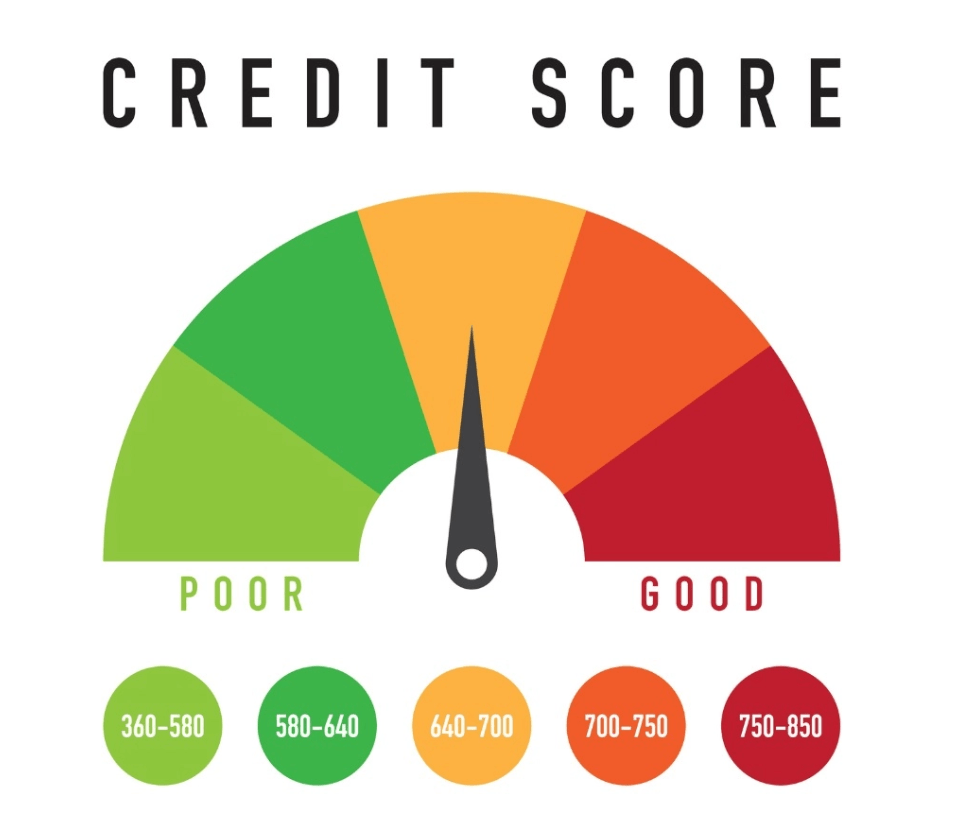

The borrowell team feb 04, 2021 • 13 min read your credit score directly impacts your ability to get approved for financing, including credit cards, loans, and mortgages.

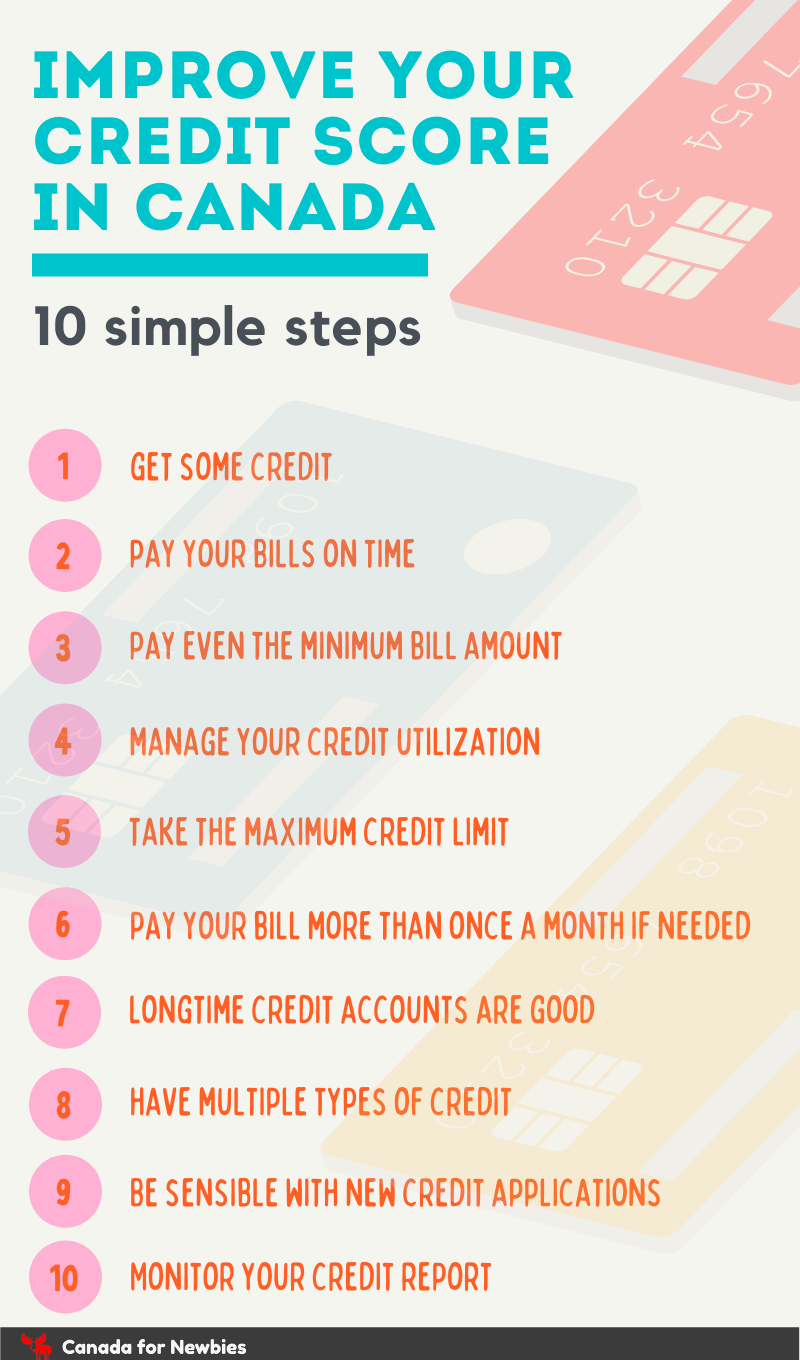

How to improve your credit score canada. To improve your payment history: This is possibly the easiest way to help build your credit rating. Payment history makes up a significant chunk of your credit.

If you are credit invisible, meaning you have no credit history in canada, or have a bad credit score, you can take several measures to build your credit history and improve. If you make the payment on time, this information. There are a growing number of ways to boost your score.

You can receive a copy of your credit report and credit. Contact your lender right away if you think you'll have trouble paying a bill 4. The higher the ratio, the worse your credit report is.

Here’s how these lines of credit work: Secured credit cards, where a cash deposit is used as a backstop but otherwise work much like a regular credit card,. Make at least the minimum payment if you can’t pay the full amount that you owe 3.

Always make your payments on time 2. One more example of needless worry about credit scores affects people who pay what they owe before their monthly statement is issued and thus may show a. And remember, pay your bills.

Pay on time one of the best things you can do to improve your credit scores is to pay your debts on time. There are a multitude of ways canadians can improve their credit score, such as ensuring monthly bills are paid on time, maintaining a low debt / income ratio, and ensuring any. Pay credit card balances strategically.

Here are ways to build your credit history and achieve a top credit score. Pay your debt on time. The portion of your credit limits you're using at any given time is.

The credit building product asks you to make a payment of $10 per month. When you apply for a credit card, a mortgage,. These strategies can help you boost your credit score and demonstrate your creditworthiness.

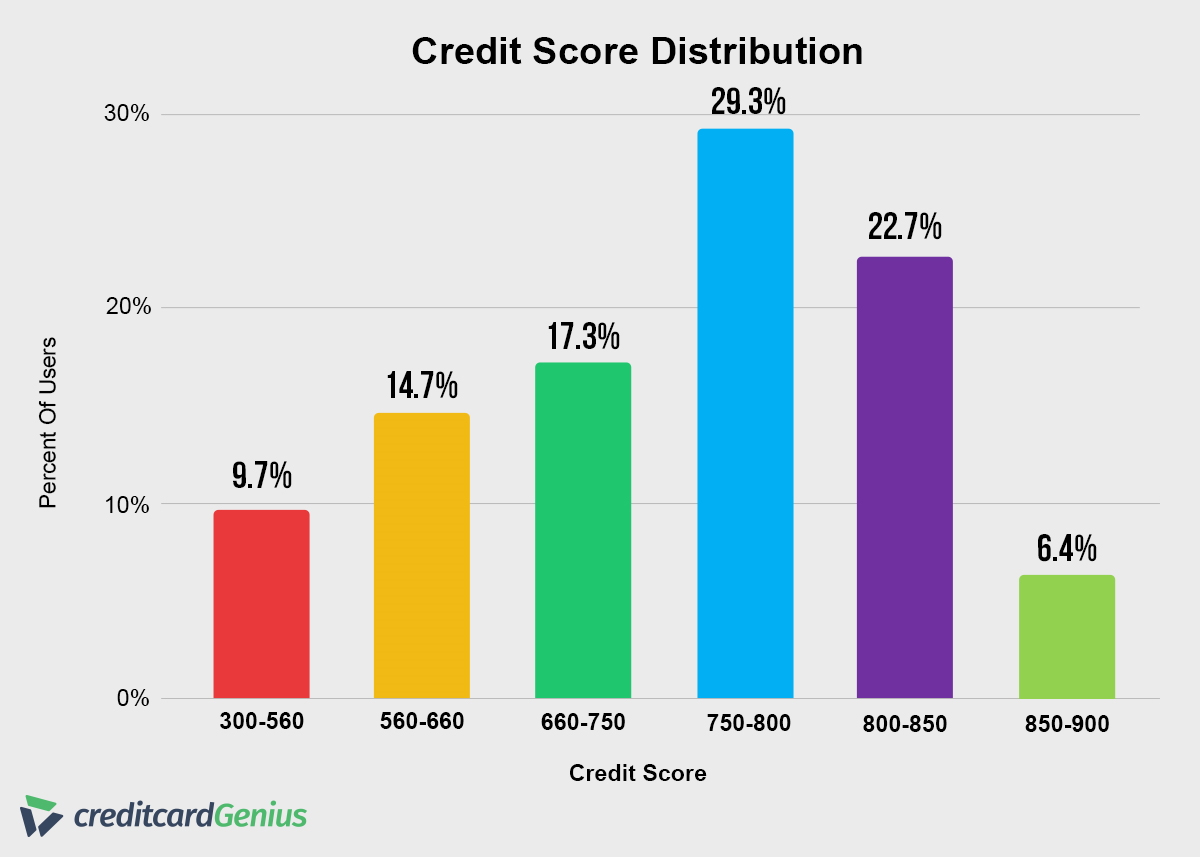

This refers to the amount of credit you’ve. Here are some strategies to quickly improve your credit: Capital one canada (for transunion score) credit karma free credit score (for transunion score) paid credit scores ($19.95/month) equifax;

You may be looking for ways to improve your credit score fast, but it’s important to know that it can take some time and patience. How to build your credit score. Pay careful attention to your credit history so you know where you stand.