Spectacular Info About How To Buy Down Interest Rate

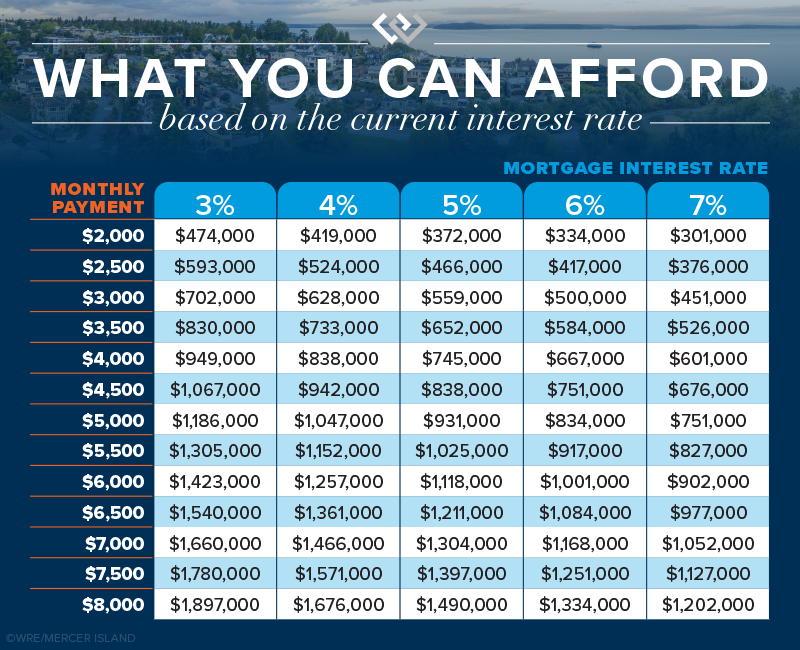

Learn how to calculate the benefits and costs of buying your rate down or paying points for a lower mortgage rate.

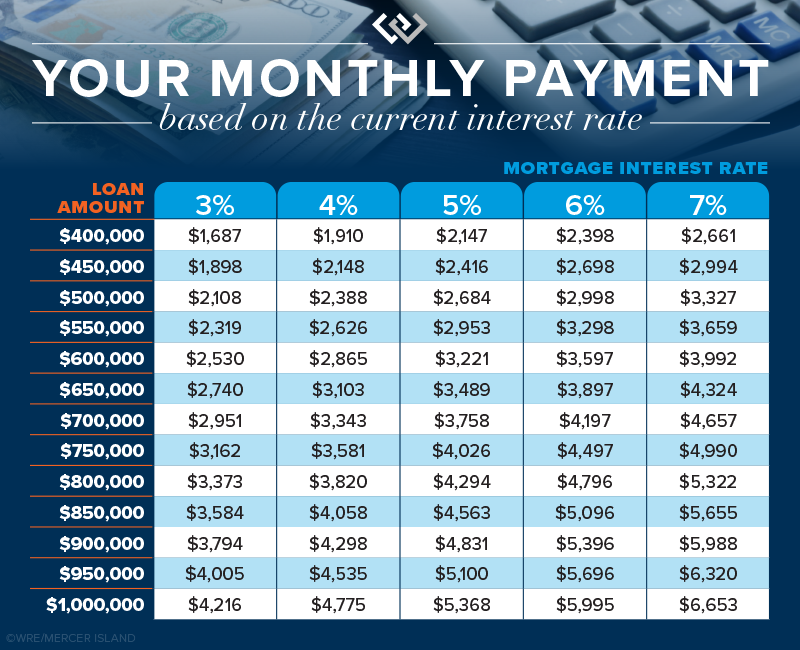

How to buy down interest rate. Start my application when comparing different mortgages, one of the most important variables you’ll need to consider is the interest rate. How does an interest rate buydown work? In the case of discount points, the interest rate is lower for the loan term.

Buying down the interest rate, also known as purchasing mortgage points, is a practice where borrowers pay a certain amount upfront to reduce their mortgage. Some market pros have been eyeing the possibility rates stay high in 2024. They're now closer to 7% than they've been.

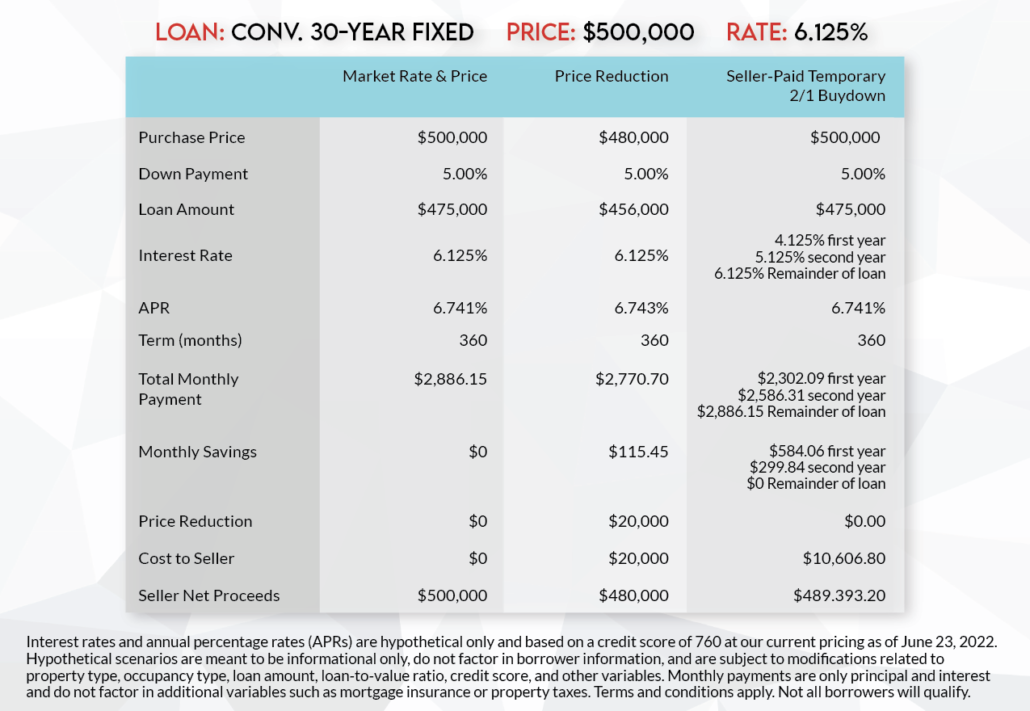

Net the seller more overall profit. A mortgage rate buydown is a financing technique that allows you to pay extra money to get a lower interest rate. Compared to a larger down payment or even paying discount points [which are equal to 1 percent of the loan amount] to permanently buy down the interest.

Personal finance mortgages seller buydowns can help home sellers struggling to find buyers in a restrictive financial environment written by andrew dehan;. Lower the initial interest on your loan—lowering initial monthly payments. A temporary buydown helps to:

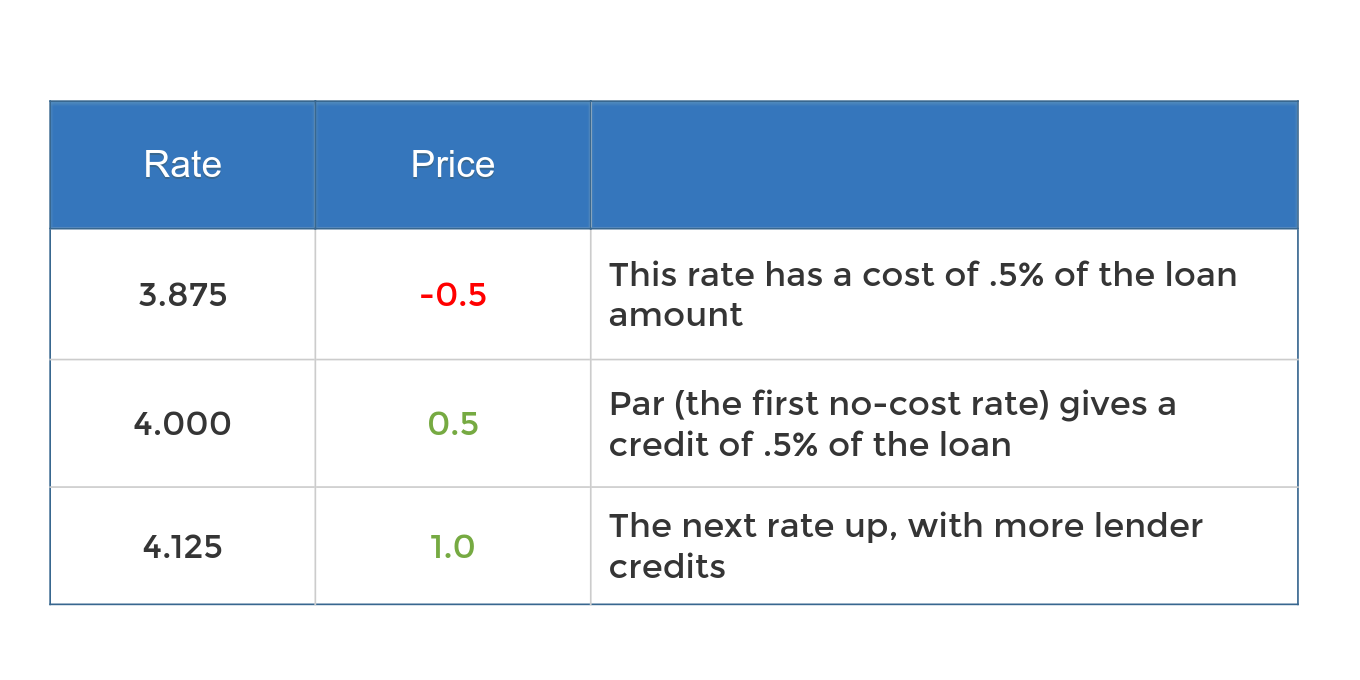

Buydowns and discount points (otherwise known as mortgage points) are both ways to lower your mortgage’s interest. Increase the appeal of your offer. The calculator uses the home’s purchase price to determine how.

Find out how to get loan quotes, compare fees,. How does a mortgage rate buydown work? February 26, 2024 / 1:29 pm est / cbs news.

Lower rates can save you money on both. It's probably not a good idea to wait for rates to fall to access your home's equity. Learn how to get a lower interest rate with a temporary buydown from the seller or builder.

A buydown is a mortgage financing technique that lowers the interest rate for a few years or the entire life of the loan. The biggest reason to buy down your interest rate is to get a lower rate on your mortgage loan, regardless of credit score. With our buying down interest rate calculator, you can estimate the cost of buying down a point.

Updated may 15, 2023 what does it mean to buy down the interest rate? In the second year, it will be 1% lower. A buydown is a way for sellers to reduce the buyer's mortgage interest rate by paying a percentage of the loan amount for a temporary period.

Learn the pros and cons, types, and costs of this. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing.

![The Impact Your Interest Rate Makes [INFOGRAPHIC] Keeping Current Matters](https://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2017/06/08170908/20170609-Cost-of-Interest-KCM.jpg)